Accounting Software for Small Businesses

Accounting for small businesses means invoices, bills, credit and debit notes—and ideally, everything tied to customers, projects, and inventory. PrimeBase gives you that: one place for your books, with inventory-linked accounting and project and vendor accounting so you can see profitability and stay audit-ready.

Simplify accounting in PrimeBaseSee it in action

Invoices, bills, credit and debit notes

Create and send invoices, record bills from vendors, and issue credit or debit notes when needed. PrimeBase keeps a clear ledger so you know what’s outstanding and what’s paid, with numbering and PDFs that look professional.

Inventory-linked accounting

When you sell or receive stock, the right accounting entries can flow automatically. That keeps cost of goods and valuation correct without manual journals. For small businesses that hold inventory, this link is what separates integrated software from a basic invoicing tool.

Project and vendor accounting

Track costs and revenue by project so you know which jobs are profitable. Vendor bills and payments are in the same system, so you have one view of payables and receivables. That’s accounting built for teams that deliver work, not just send invoices.

What you get in PrimeBase accounting

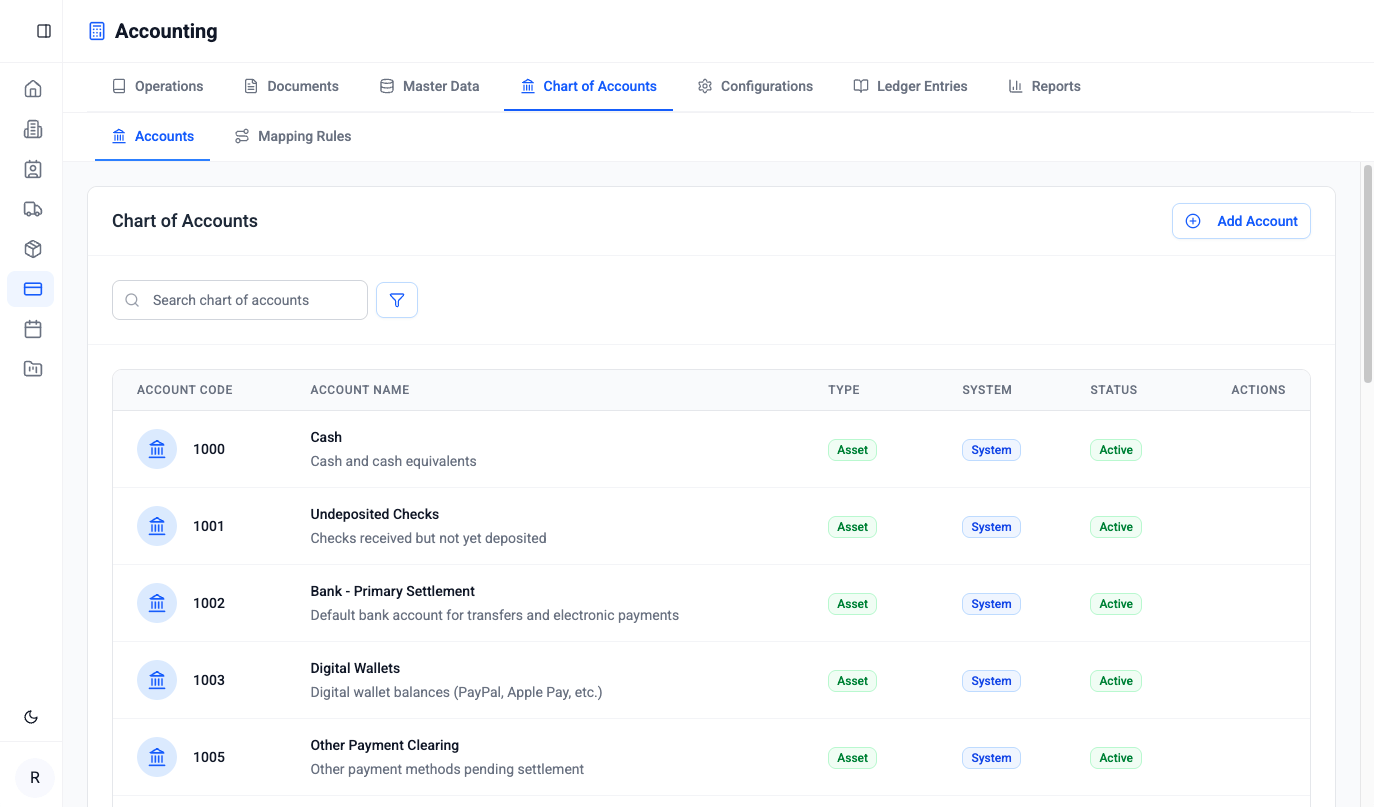

Accounting in PrimeBase is double-entry with a unified document model. You get invoices, bills, customer and vendor credit and debit notes, payment receipts and disbursements, advances and refunds, and journal entries—all with configurable numbering and approval workflows. The chart of accounts and posting rules resolve automatically so the ledger stays correct. Multi-currency and multi-bank are supported, and inventory movements post to COGS and inventory accounts. Addresses (billing and shipping) and a full audit trail are built in, so your accounting software for small businesses stays audit-ready.

Related solutions

Go deeper with these workflows: